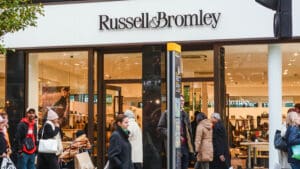

Russell & Bromley, the 150-year-old luxury footwear and accessories brand, could vanish from the UK high street after a proposed takeover by Next that is expected to lead to the closure of all 37 of its stores.

Around 450 jobs are understood to be at risk under a deal that would see Next acquire only the Russell & Bromley brand and intellectual property, while the retailer’s physical estate is wound down.

Next is working alongside stock clearance specialist Retail Realisation, which is expected to oversee store closures and a fire sale of remaining inventory if the deal completes. Retail Realisation is linked to Modella Capital, a fast-growing player in high street restructurings.

Founded in 1880 in Eastbourne, Russell & Bromley was born out of the marriage of Elizabeth Russell and George Bromley, both from shoemaking families. The business has remained family-owned for five generations and is currently run by Andrew Bromley.

The potential break-up marks another chapter in the rapid reshaping of the UK retail landscape, as brands with long trading histories struggle under the combined pressure of weak consumer confidence, rising costs and structural changes to the high street.

Modella Capital, via Retail Realisation, has emerged as a prominent force behind recent retail rescues and collapses. Last year, it acquired WHSmith’s 480 high street stores in a £76 million deal, rebranding the chain as TGJones while being prevented from closing large numbers of shops under the terms of the sale.

The group has also invested in Paperchase and Tie Rack, bought arts and crafts retailer Hobbycraft in 2024, and acquired The Original Factory Shop and accessories chain Claire’s. However, both of those businesses were placed into administration last week, putting around 2,500 jobs at risk.

In announcing those administrations, Modella cited what it described as “highly adverse government fiscal policies”, alongside high inflation and subdued consumer demand.

For Next, the proposed Russell & Bromley deal fits a well-established strategy. Over the past decade, the retailer has snapped up distressed or underperforming brands including Cath Kidston, Joules and Seraphine, often retaining the brand while exiting loss-making physical retail.

Unlike many of its former rivals, Next has avoided major setbacks on the high street. While names such as Debenhams and Topshop collapsed, Next has successfully pivoted towards younger consumers and a stronger digital-led model.

The group raised its profit forecast again last week after a stronger-than-expected Christmas trading period, its fifth upgrade in the past year. Sales in the nine weeks to 27 December rose 10.6 per cent year on year, with UK sales up 5.9 per cent — ahead of expectations.

In a trading update, Next said performance benefited from improved stock availability compared with last year, when global freight disruption and supply issues in Bangladesh weighed on sales.

Russell & Bromley, Next, Retail Realisation and Modella Capital have been approached for comment.

Read more:

Russell & Bromley faces high street exit as Next takeover puts 450 jobs at risk